personal property tax rate richmond va

The median property tax in richmond city virginia is 2126 per year for a home worth the median value of 201800. Monday - Friday 8am -.

Virginia Property Taxes By County 2022

June 5 and Dec.

. Richmond VA 23225 804 230-1212. Map to City Hall. Farm animals except as exempted under 581-3505.

Personal Property Tax also known as a car tax is a tax on tangible property - ie property that can be touched and moved such as a car or piece of equipment. This applies only to taxes on personal property such as cars passenger trucks motorcycles boats and trailers. If you are contemplating moving there or just planning to invest in the citys property youll come to know whether the citys property tax rules work for you or youd.

Use the map below to find your city or countys website to look up rates due dates. Vehicle License Tax Antique. If you have questions about your personal property bill or would like to discuss the value.

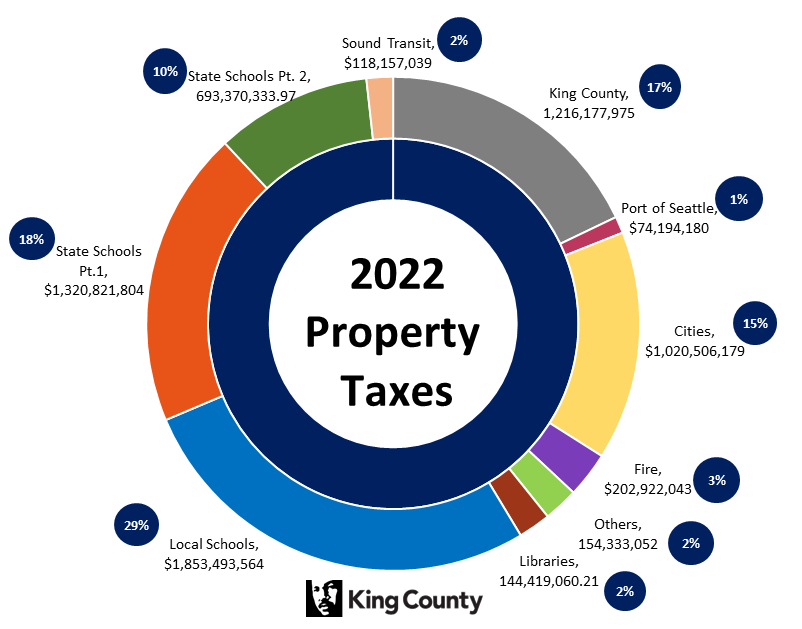

Richmond City has one of the highest median property taxes in the United States and is ranked 394th of the 3143 counties in. Since home values in many parts of Virginia are very high though Virginia homeowners still pay around the national median when it. Invoice Cloud is a convenient payment option for paying real estate taxes and motor vehicle personal property taxes include creditdebit cards e-checks scheduled payments and automatic payments Auto-Pay.

Monday - Friday 8 am. In addition Henrico maintains a personal property tax rate for vehicles of 350 per 100 of assessed value which is the lowest among major localities in the region. Richmond VA 23219 Map it 804646-7000 Hours.

PAY YOUR PERSONAL PROPERTY TAXES ONLINE OR BY MAIL. The Local Tax Rates Survey is published by the Department of Taxation as a convenient reference guide to selected local tax rates. The Commissioner of the Revenue is responsible for assessing personal property taxes VA Code Sec 581-3100-31231.

Vehicle License Tax Vehicles. In accordance with The Code of Virginia 581-3503 the City of Richmond uses the Clean Trade-in value established by NADA as fair market value and this has resulted in an increase to. Yearly median tax in Richmond City.

A higher-valued property pays more tax than a lower-valued property. 12 hours agoThe current personal property tax rate for vehicles in Chesterfield is 360 per 100 of assessed value. Studying this recap youll get a good understanding of real property taxes in Richmond and what you should be aware of when your propertys appraised value is set.

14 hours agoThere are several ways that residents can pay their personal property taxes. With an average effective property tax rate of 080 Virginia property taxes come in well below the national average of 107. If you have questions about personal property tax or real estate tax contact your local tax office.

Personal property tax bills have been mailed are available online and are due June 5 2022. Business Tangible Personal Property Tax Return2021 2pdf. Richmond - 370.

It is an ad valorem tax meaning the tax amount is set according to the value of the property. The median property tax in Richmond City Virginia is 2126 per year for a home worth the median value of 201800. Business Tangible Personal Property Tax Return Richmond.

It is possible that the portion of the total personal property tax on your vehicle that you have to pay may increase as the number of. General classification of tangible personal property. Map of Traffic Hazards.

Richmond City collects on average 105 of a propertys assessed fair market value as property tax. Box 70 Chesterfield VA 23832.  This information pertains to tax rates for Richmond VA and surrounding Counties.

By mail to Treasurers Office Chesterfield County PO. Real Estate Taxes. Tangible personal property is classified for valuation purposes according to the following separate categories which are not to be considered separate classes for rate purposes.

However all that is little comfort to all those car owners who now must pay a lot more in taxes. Vehicle License Tax Motorcycles. Richmond City collects on average 105 of a propertys assessed fair market value as property tax.

Personal Property Taxes are billed once a year with a December 5 th due date. Tax Rate per 100 of assessed value Albemarle County. Tax rates differ depending on where you live.

Richmond City has one of the highest median property taxes in the United States and is ranked 394th of the 3143 counties in. If you live in Chesterfield County you may have noticed a spike in personal property taxes especially when it comes to your car. The county also can consider high mileage and damage beyond regular wear and tear in assigning values to vehicles.

My office has used the same assessment methodology for at least 35 years. Car Tax Credit -PPTR. Local Taxes Personal property taxes and real estate taxes are local taxes which means theyre administered by cities counties and towns in Virginia.

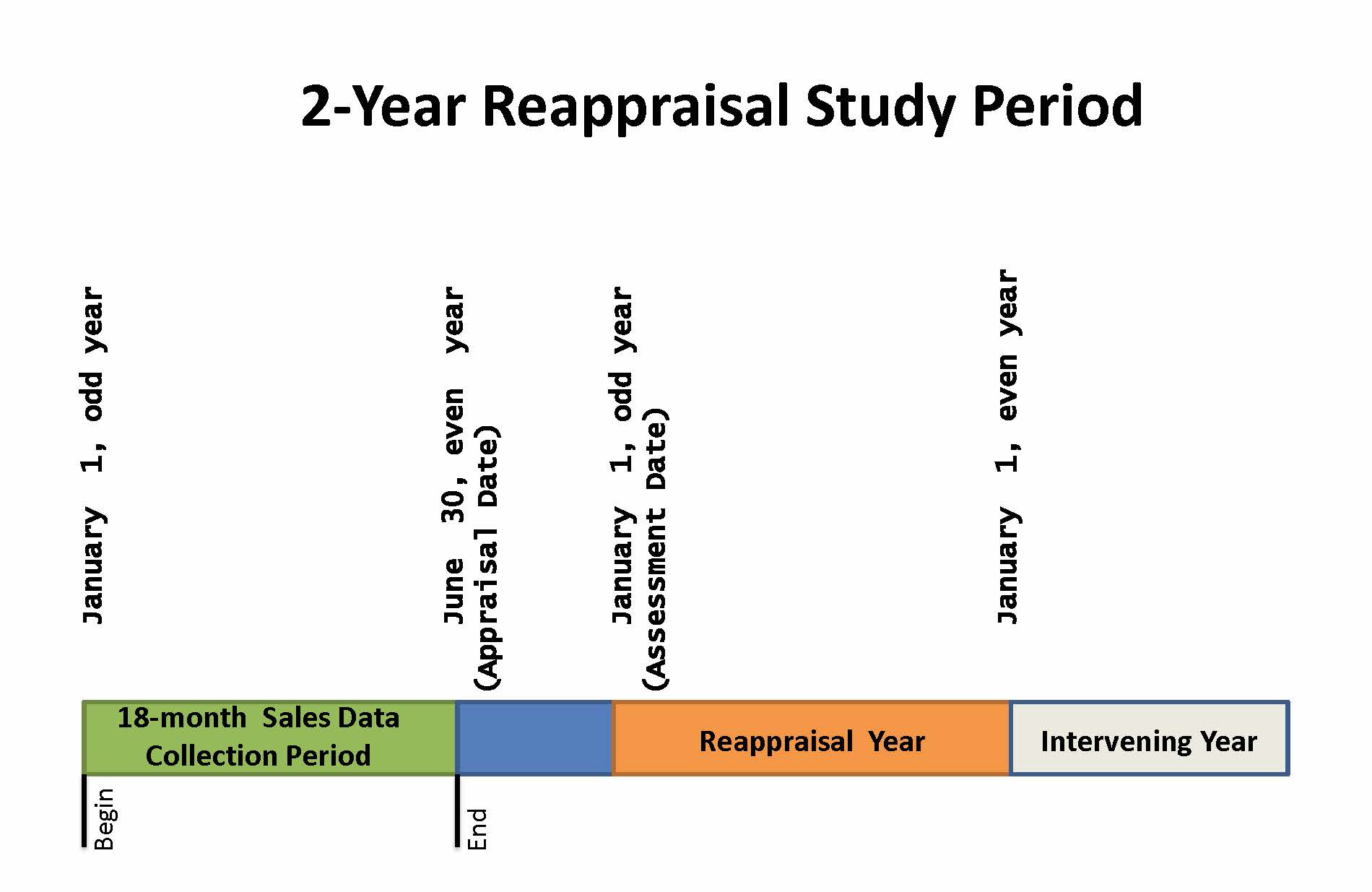

Local taxes personal property taxes and real estate taxes are. Personal Property Taxes are assessed on any vehicle motorcycle boat trailer camper aircraft motor home or mobile home owned and registered as being garaged in Richmond County as of January 1 st of each tax year. Broad Street Richmond VA 23219.

The tangible personal property tax is a tax based on the value of the property commonly referred to as an ad valorem tax. Richmond VA 23225 804 230-1212. Personal Property Registration Form An ANNUAL.

The median property tax in Richmond City Virginia is 2126 per year for a home worth the median value of 201800. Which holds a grand re-opening after 30 million renovation in Richmond Va on.

Pay Online Chesterfield County Va

Pay Online Chesterfield County Va

News Flash Chesterfield County Va Civicengage

Property Taxes How Much Are They In Different States Across The Us

Many Left Frustrated As Personal Property Tax Bills Increase

Virginia Historic Tax Credits Tax Credits Historic Properties Historical

Youngkin Signs Bill To Reclassify Certain Vehicles And Personal Property Tax Rates Wric Abc 8news

How To Reduce Virginia Income Tax

Virginia Property Tax Calculator Smartasset

Property Assessment Process Adams County Government

Loudoun S Data Center Tax Revenue Is Accelerating At An Insane Pace Washington Business Journal

Population Wealth And Property Taxes The Impact On School Funding

Population Wealth And Property Taxes The Impact On School Funding

Henrico Leaders To Vote On Personal Property Tax Bill Extension

Get The Title Of Property Reviewed Before Selling Title Insurance Title Buying A New Home